Build Business Credit Fast: Simple Steps for New Businesses

Most entrepreneurs think business credit is something you build later — after you’re established, after revenue comes in, after things finally feel “real.” But if you want to build business credit fast, that mindset will slow you down.Because the truth is simple:The fastest, smartest way to grow your business is by using business credit to […]

Most entrepreneurs think business credit is something you build later — after you’re established, after revenue comes in, after things finally feel “real.”

But if you want to build business credit fast, that mindset will slow you down.

Because the truth is simple:

The fastest, smartest way to grow your business is by using business credit to fund the growth you want — not waiting for money to magically appear.

And yes… you can do this even if your business is new or still finding its rhythm.

When I was starting out as a web designer, I was already serving clients, building brands, and designing websites for beauty pros. But business came to a halt while I focused on building new products, refining my offers, and preparing for a full relaunch. I needed structure — and funding — to move forward.

My supportive boyfriend helped me cover the upfront cost to officially register my business. Everything after that came from understanding credit, strategy, and timing — and following the exact steps below.

Here’s the framework that helped me build business credit fast and fund my growth (without drowning my personal credit).

And when I say “fast,” I mean without vendor tradelines or NET 30 accounts. You can build business credit fast by using real bank relationships and strategic business credit cards that actually move you forward.

1. Strengthen Your Personal Credit First

Before banks trust your business, they look at you.

These are the data points most lenders check:

✔ 680–720+ FICO

✔ Low utilization (under 10%)

✔ No recent late payments

✔ Under 3 inquiries per bureau in the last 6 months

✔ A few high-limit cards ($5k+)

✔ At least one account open 2+ years

You do NOT need perfect credit — you just need a healthy, consistent profile lenders feel safe with.

If you want more strategy on building a strong business foundation, check out my

👉 7 Website Secrets to Get More Bookings

(This freebie helps new business owners strengthen their online presence, which ties directly into lender trust.)

2. Set Up Your Business So It Looks “Fundable”

A clean business structure helps you build business credit fast because lenders want to see legitimacy.

Make sure you have:

✔ LLC

✔ EIN

✔ Business checking account

✔ Matching business name + address everywhere

✔ Professional website + online presence

Banks deny people every day for simple mismatches — not because they’re unqualified.

3. Build a Relationship With 1–2 Banks

Choose two banks and stay loyal. Best options for new business owners:

– Chase

– Navy Federal

– Bank of America

– Amex

Open a business checking account, even if deposits are small at first.

Banks care more about activity and consistency than your day-one revenue.

You can build business credit fast even if your business is new — what matters is the strategy.

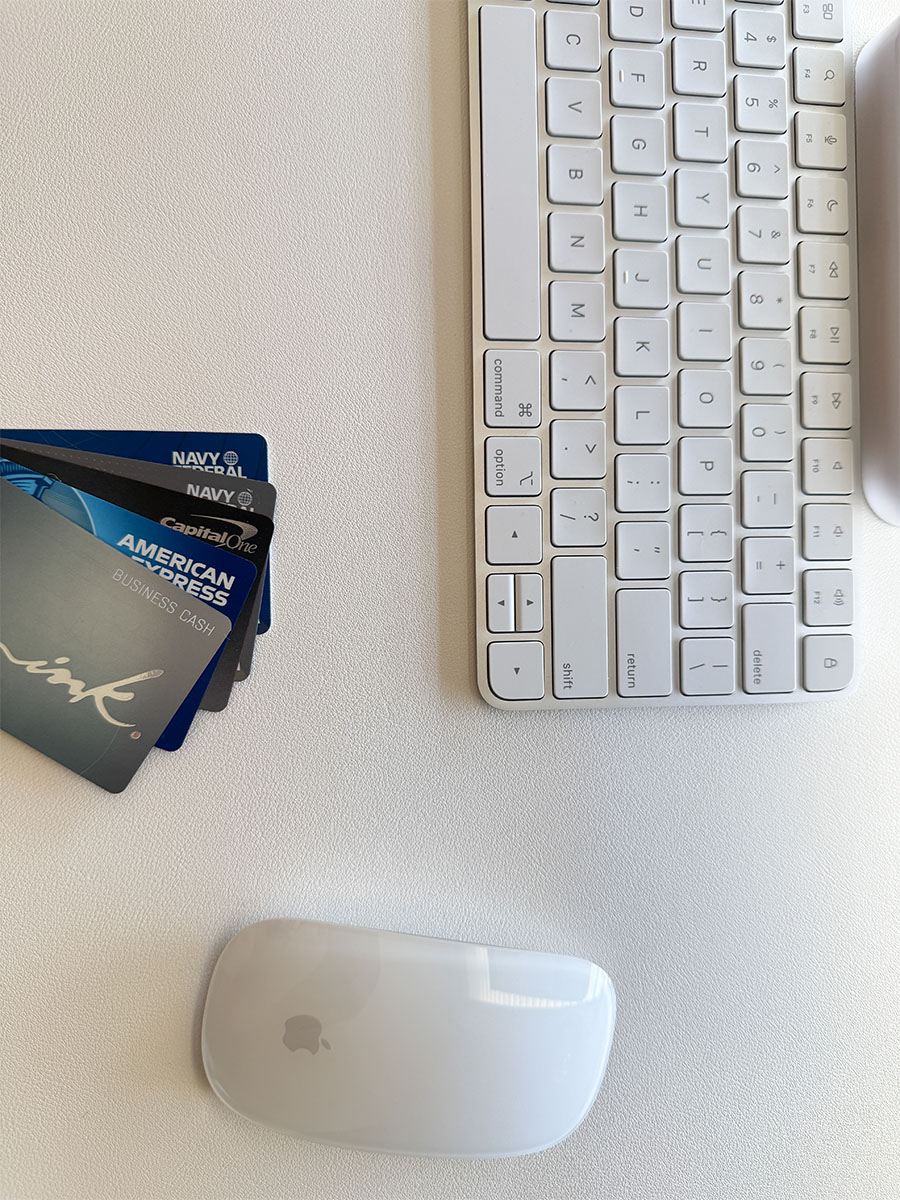

4. Apply for Your First Business Credit Cards

Once your business structure is in place, start with cards that report to business bureaus — not your personal credit.

Top beginner-friendly options:

✔ Chase Ink Business Cash → [browse the selection]

✔ Chase Ink Unlimited → [browse the selection]

✔ Amex Blue Business Cash

✔ Amex Business Gold

✔ Navy Federal Business Rewards

Why these work:

– Higher limits

– Don’t affect personal utilization

– Better rewards for business spending

– Help build business credit fast

And again, “fast” does not mean opening vendor accounts or stacking NET 30s. You can build business credit fast using legitimate bank-issued credit cards — no unnecessary tradelines required.

This is how you fund equipment, education, branding, website upgrades, and scaling — without draining savings.

5. Avoid These Common Mistakes

To continue building business credit quickly, avoid:

❌ Applying for too many cards too fast

❌ Using high utilization on personal cards

❌ Closing old accounts

❌ Spreading spending across too many banks

❌ Waiting for “perfect” credit

Credit is about patterns, not perfection.

6. Use Personal Credit as a Lever (Not a Crutch)

You do NOT need established business credit to get business credit.

If your personal credit is clean and structured, you can qualify for most beginner cards even with a newer business.

Those cards then help you build your business profile fast, opening the door to:

✨ higher-limit business cards

✨ 0% APR opportunities

✨ business lines of credit

✨ long-term funding

This is how you scale without self-funding everything out of pocket.

What to Do Next

✨ Step 1: Review your personal credit

✨ Step 2: Set up or clean up your business structure

✨ Step 3: Open business checking with 1–2 banks

✨ Step 4: Apply for your first business cards → browse the selection

✨ Step 5: Use business funding to grow what matters:

– branding

– website

– education

– equipment

– marketing

– client experience systems

These steps will help you build business credit fast and scale without relying on personal savings.

Your business doesn’t need more waiting.

It needs structure, strategy, and leverage.

And the best part?

You don’t have to do it alone — business credit is designed to help you grow faster than you ever could with savings alone.

© 2025 beauty brand haus | ALL RIGHTS RESERVED | SITE DESIGN BY beauty brand haus